It all started with a knock on my front door and a certified letter …

It all started with a knock on my front door and a certified letter …

Like most people, budgeting wasn’t one of the top things on our to-do list. Yes, we paid the bills (for the most part), but we bought what we wanted when we wanted and if we had to pay a few things late then we made do. Except eventually the lack of organization started to catch up to us and before we knew it, we had dug ourselves into a hole.

I wasn’t one to pay the bills. Yes, I assumed they were getting paid but I had a few of my own and those were the ones I watched. Before I knew what was going on, we were a few months behind on every bill, piling up the late fees, and maxing out our credit cards. I knew it was time to take an active roll in our finances and put us in a better spot as we embarked on our new journey of parenthood.

In just six months I was able to pull all of the bills not only back on track, but a few months ahead, pay off all of our credit cards, save $10,000, pay off a $14,000 loan, and collaborate the rest of our debts into one low-interest loan. Was it easy? absolutely not. More than once Brett got the phone call asking why he spent $2 at Tim Hortons but every little bit of nickel and diming absolutely paid off.

Here is how we completely turned around our situation and set up our future for success and growth:

- First things first, we opened up another bank account. We called this our bills account and decided that absolutely nothing besides bills would come out of this account. We set up the necessary amount needed in there each check and have it automatically deposited in there each week. We don’t have access to this account with checks or debit cards. This makes sure that we cant impulsively use this account for anything unnecessary and if we needed we would have to physically go to the bank and remove the money.

- We have another bank account we call the joint account. This is what we use for

everything else such as gas and groceries. I say just those two things because during this six month period we didn’t allow ourselves to buy ANYTHING else except once a week we would get take out or dine out at a (cheaper) restaurant.

everything else such as gas and groceries. I say just those two things because during this six month period we didn’t allow ourselves to buy ANYTHING else except once a week we would get take out or dine out at a (cheaper) restaurant.

- This leads me to my next point, cut out every unnecessary purchase. For us, since it was still the two of us, it was our daily coffees, getting my nails done, and eating out downtown with cocktails and appetizers. No more random shopping trips when I was bored and absolutely no impulse buying.

- Some other HUGE unnecessary expenses are at the grocery store. I know I think that as long as it’s spent at Kroger or Meijer then it must be deemed “groceries” and then it’s allowed but there are so many ways to waste money at the grocery store.

- I like to cut cost and waste by eating the same few meals every day. This cuts out all of the different and expensive snacks. Also, incorporating some of the same ingredients in a few nights dinners and making large meals to have a few days of leftovers helps too!

- Want to eat out? Grabbing take out saves money on beverages and service tips!

- The first step we took in tackling the huge task ahead of us was cutting out the credit cards! I know the more you find yourself behind, the more they are needed, but it only makes things worse! STOP USING THE CARDS! I took ours out of our wallets and put them in a safe spot.

- Next, write down all of your credit cards and their balances. I put ours in order from smallest amount to largest. There are many different ways people believe in tackling debt, but what worked best for me was paying off the smallest amounts first.

- I allocated a set amount of money each month to go to credit cards. I paid 50% of that money on the smallest debts first and then split the rest evenly among the other cards. Once the smallest debt was paid off, I added that amount of cash to the next smallest debt as well as the amount I was already paying towards that card each month. As the amount I owed diminished, the more money I was paying towards the larger cards. This is called the Snowball method.

- Another thing many people don’t know is that credit companies will work with you if you are SIGNIFICANTLY overdue or delinquent. Give them a call. You will have to pay at least half down initially but they will let you work out a plan. (Keep in mind you will have to pay taxes on any forgiven money at the end of the year!)

- Next, write down all of your credit cards and their balances. I put ours in order from smallest amount to largest. There are many different ways people believe in tackling debt, but what worked best for me was paying off the smallest amounts first.

- Know your situation! Sounds easy enough but how many of you don’t step on a scale because if you don’t know your actual weight you can’t get upset?! Same thing with your bank accounts! Every single morning I wake up and the first thing

I do is check my balances.

I do is check my balances.

- As well as having your banks app on your phone, download your other expenses apps such as sprint, DTE, cable. This makes bill paying quick and easy.

- Also, I keep paper copies of my bills when they come in the mail. I like to physically see them, seeing is believing! I do not opt out and have them emailed (I know we want to save paper but do you think these large businesses really care about that or do they hope you forget to pay and they get to fine you?).

- Stop all random expenses. Countless times I would wake up and look at my account and see random withdrawals I wouldn’t expect. I would plan to have this much money left after paying my bills and then out of nowhere I would have half the amount. Things such as iTunes, Spotify, and PayPal charges seem so small that they are easy to forget about. They add up! I deemed these unnecessary and canceled them for the time being.

- As well as having your banks app on your phone, download your other expenses apps such as sprint, DTE, cable. This makes bill paying quick and easy.

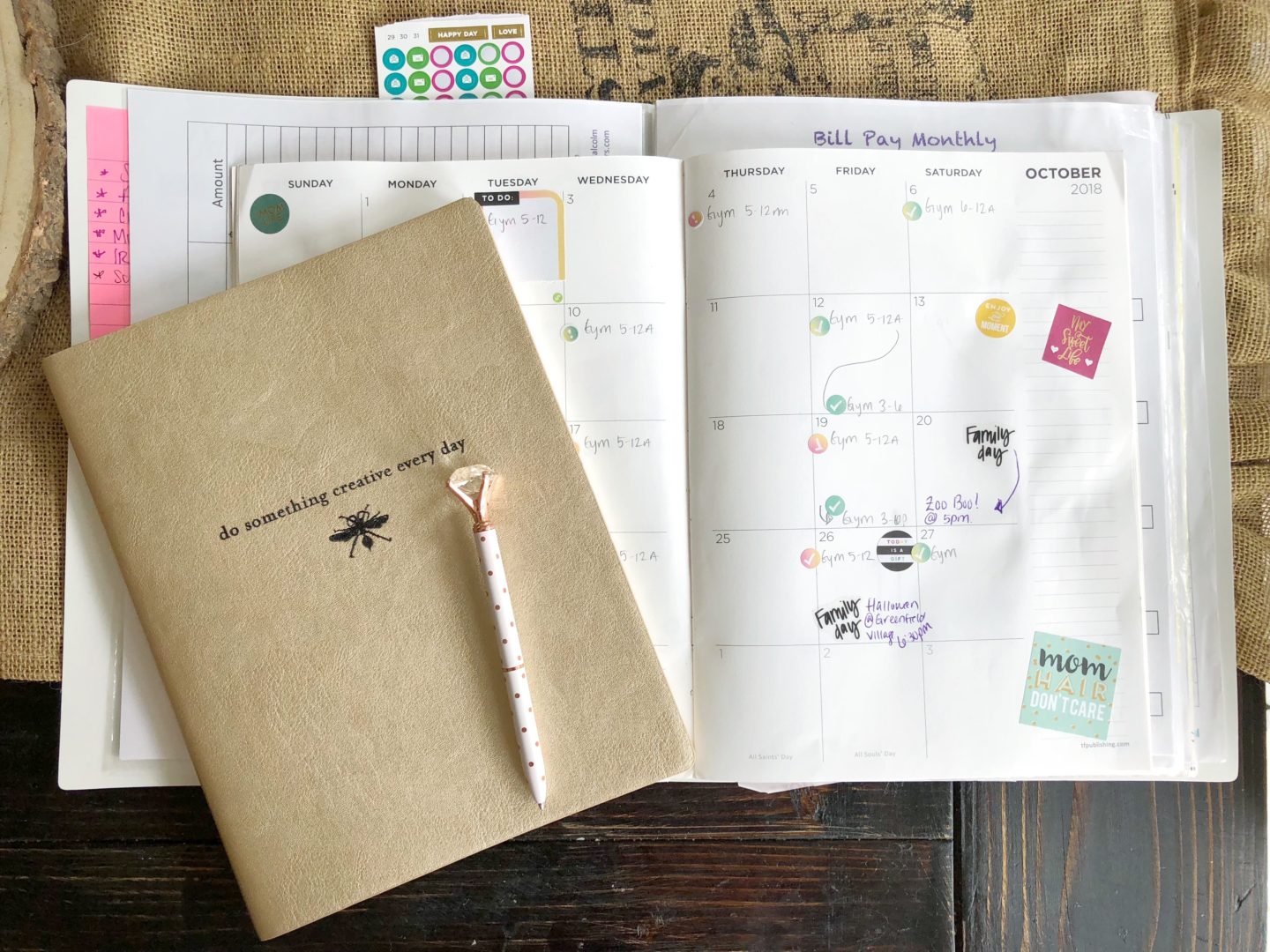

- Be organized! Like in my previous post, I created a Budget Book to keep

everything in line. From here I started by figuring out how much money I needed weekly for things such as gas and groceries. I then subtracted them from the total monthly income and split up the remaining money equally. Then I write down which week I would pay each bill.

everything in line. From here I started by figuring out how much money I needed weekly for things such as gas and groceries. I then subtracted them from the total monthly income and split up the remaining money equally. Then I write down which week I would pay each bill.

- IGNORE DUE DATES. No, I don’t mean not paying on time, but pay ahead! When the check comes I look at my budget book and whatever expenses are meant to come out of that money I pay them. I do not set up autopayments because I prefer the money to come out immediately so there is no risk in it being spent.

- Split the bills up equally! Like I said before, I split all expenses equally so that one check I am not left with significantly more or less than another. By doing this, you are able to be more consistent with your remaining money.

- To split my expenses equally, I take big payments like my home and vehicles and split up those bills. That means the first weeks check I’ll take half of my house payment and half of my vehicles payment and put it into the bills account. Then the next check I put the remaining money in that account and pay the bill.

- Next, Increase your income! Easier said than done? NO! There are many ways these days to make money. My husband worked his butt off these six months (and always). He picked up as much overtime as he possibly could. As for me? I used my talent of sewing to sell competition bikinis and did minor clothing alterations.

- A few other things we did to make more money was having a yard sale and selling online such as craigslist and facebook marketplace. You wouldn’t believe the things people will buy if you aren’t using it sell it!

- The key point here is: When you get this extra money, apply it DIRECTLY AND ENTIRELY to your debts. Do not just add it your weekly allowance. You’ve set that amount and you shouldn’t “need” it. Pay off a credit card or something else that will help you in the long run and not just for the time being!

- The key point here is: When you get this extra money, apply it DIRECTLY AND ENTIRELY to your debts. Do not just add it your weekly allowance. You’ve set that amount and you shouldn’t “need” it. Pay off a credit card or something else that will help you in the long run and not just for the time being!

- A few other things we did to make more money was having a yard sale and selling online such as craigslist and facebook marketplace. You wouldn’t believe the things people will buy if you aren’t using it sell it!

- Lastly, I took all of my remaining debts (except credit cards) and combined them into one super low-interest loan through my bank. You could do this with your credit cards as well! With this loan, I set aside every extra penny I could muster and force myself to pay that amount each month. I ignored the actual payment amount and paid double the amount AND took every extra dime I had from selling things and working over and put it towards this loan. The goal is to get all

debts paid off as quickly as possible!

Honestly, this six months of our lives was HARD but it was just that, six months. By forcing us to stay on top of it and live frugally for a short time period, we are now able to be more comfortable and no longer live paycheck to paycheck. It may take you longer or it may take less time but just keep your focus! It is SO worth it!!