Hey guys! Happy Monday! What better way to start the work week than with a little bit of budgeting and organizing! This post is going to be a little bit different than my past few! I have been getting a TON of questions regarding the budget sheet that I posted on my Instagram and I figured it was definitely worth going over!

Let’s rewind to a year and a half ago. My husband and I were just looking to start a family. We didn’t budget, we ate out a few times a week, and I personally had no idea if the bills even got paid. I bought whatever I wanted when I wanted. Deep down I knew that we needed a change. Occasionally I would see a late notice in the mail and just shrug it off. We were living the young, dumb, and clueless life.

Then it all caught up to us.

Without going into too much detail, the bills were behind. Very much so and I realized we were living well beyond our means. I had just found out I was pregnant and knew there was absolutely no way I could bring a baby into the situation we were in. So I decided that it all was going to change.

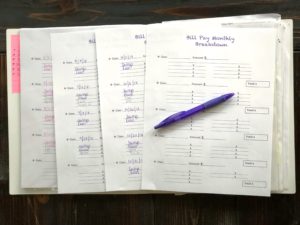

This is where my Budget Book came to life.

Being an organizational freak, I knew I needed everything written, printed, and laid out  for me. I started by getting a portfolio folder. You can use any type you’d like of course but I like having all the pages visible and kept clean. I had my husband write down every login and password to each company we paid bills to. I put this sheet on the very first page of my portfolio so that I could quickly access it when needed. You can download my form here: PasswordsandLogin

for me. I started by getting a portfolio folder. You can use any type you’d like of course but I like having all the pages visible and kept clean. I had my husband write down every login and password to each company we paid bills to. I put this sheet on the very first page of my portfolio so that I could quickly access it when needed. You can download my form here: PasswordsandLogin

The idea behind this “Budget Book”, is that you should have everything you need in one spot. The most important factor in creating a healthy budget, or in my case pulling yourself out of extreme debt, is figuring out what amount of cash you have going out compared to what you have coming in. The next page in my book is my list of bills. On this sheet, you want to list every payment you make on a monthly basis. You will want to put the amounts of each bill or a range if they change each month. As well as the due date or the rough estimated due date if they change as well. At the bottom of the page is a spot to put down your total monthly expenses. This will give you a better idea of what you have left after the bills are paid. You can get the sheet I made by clicking here: Bill list

Next, and what I find to be the most helpful and important sheet is my Bill Pay Monthly Breakdown sheet. My husband and I are lucky enough to have our checks fall on opposite weeks. This means we have money coming in each week! Regardless of how your paychecks work out, this sheet is the key component in mapping out your month.

Next, and what I find to be the most helpful and important sheet is my Bill Pay Monthly Breakdown sheet. My husband and I are lucky enough to have our checks fall on opposite weeks. This means we have money coming in each week! Regardless of how your paychecks work out, this sheet is the key component in mapping out your month.

I start by writing down the dates of each paycheck and the amount or rough estimate they will be. Then I fill in the mandatories per check, for us this means savings each week and house payment (we like to split ours up into two payments instead of one). From there I work backward and determine how much leftover we need to make it through the week (groceries, gas, etc.) Then from there, I fill in the rest of the must pays like cable, vehicles, gas and electric, etc. This allows me to evenly split up the bills throughout the month. The form is a lifesaver for me because not only can I prepare for certain expenses but I can plan multiple months in advance.

Lastly, I put a monthly calendar so I can better plan what needs to be paid when. With this, I can visually see when the paychecks come in compared to when the bills are due.

The rest of my portfolio pages are used for monthly bill statements, a summary of loans, and record keeping of paid bills. I also insert a few “pockets” to hold my planner stickers, grocery coupons, goals, etc.